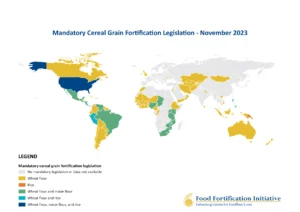

Public-private partnerships are redefining how food fortification tackles micronutrient deficiencies, but success hinges on more than just mandates. This article explores what works and what doesn’t by examining global initiatives that combine public health goals with private-sector scale. Despite mandatory fortification laws in 142 countries, micronutrient deficiencies still affect over 4 billion people [1–3]. The gap lies in weak enforcement, fragmented regulation, and limited investment. By highlighting practical tools and collaborative models, this article offers insights into solutions for closing the implementation gap and achieving real nutritional impact.

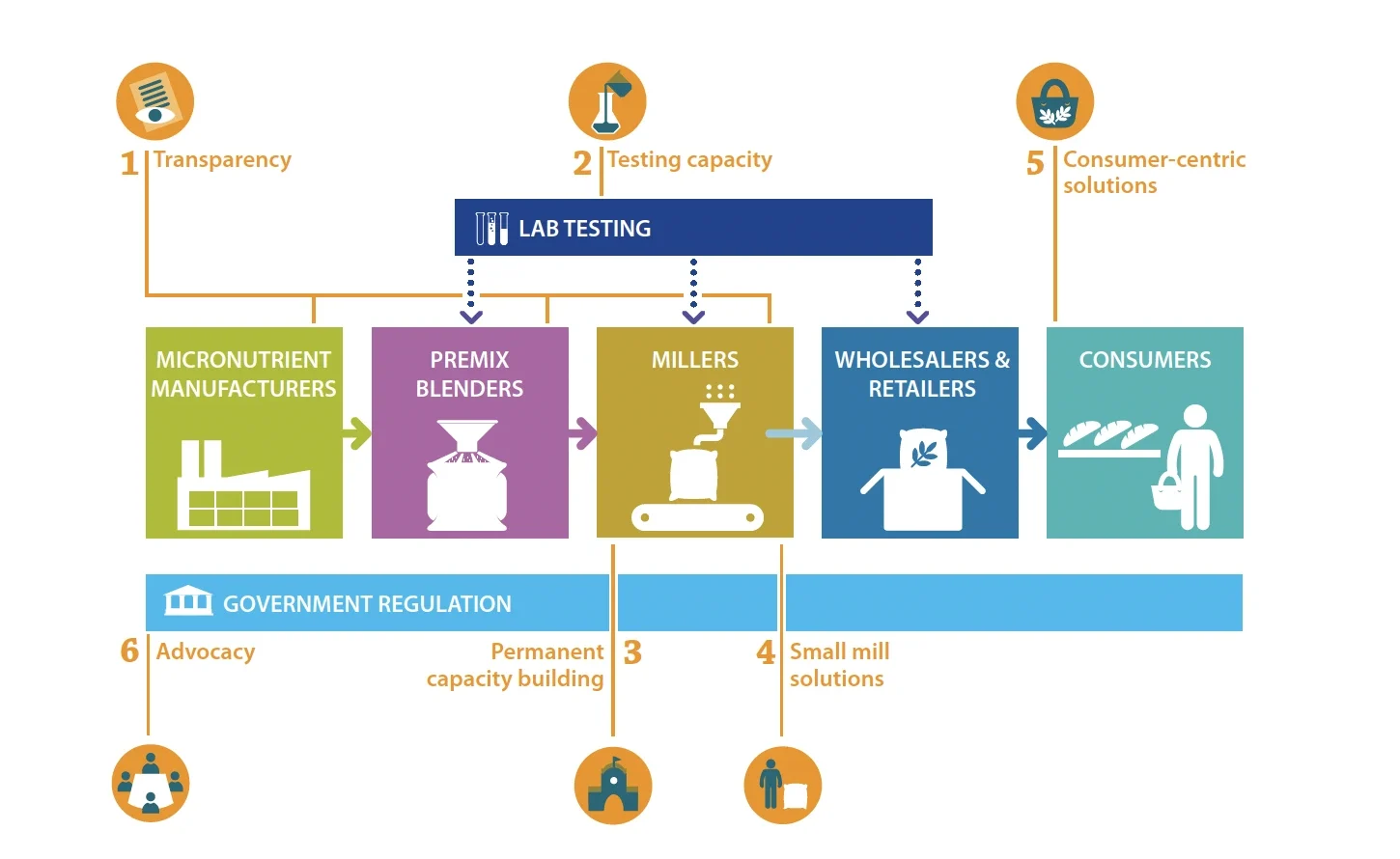

Public and Private Sector Roles in Food Fortification

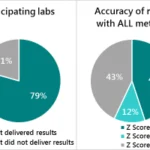

Food fortification initiatives are traditionally spearheaded by public institutions, relying on national mandates and regulatory enforcement. However, of the 142 countries with fortification mandates, only 36 collect enforcement data, and just 18 achieve over 80% compliance [3]. These figures point to a major implementation bottleneck and highlight the urgent need for deeper private sector involvement.

Private sector actors bring the scale, technical innovation, and influence needed to make fortification effective. Initiatives such as Millers for Nutrition and the Micronutrient Fortification Index in Nigeria demonstrate how technical support, data-sharing, and industry recognition can significantly enhance compliance and drive uptake [6].

Barriers to Fortification

Despite clear benefits, processors face significant challenges. One of the most critical is cost. In Bangladesh’s oil sector, even a 1% increase in retail price due to fortification costs can shrink margins by up to 43% [7]. Premix expenses are a major contributor, making up 65–70% of total fortification costs, with import taxes and duties adding another 20-30% in countries like Nigeria and Senegal [12]. For many processors, 1% of the retail price represents the maximum feasible increase they can absorb without losing competitiveness [12].

Enforcement gaps further complicate matters. In weakly regulated markets, companies that comply with fortification laws are disadvantaged, bearing higher costs while non-compliant competitors continue to operate with impunity. Consumer awareness also remains low. Misunderstandings and skepticism about fortified foods persist, particularly in areas where diet diversity is minimal and nutrition needs are highest [8].

Another complication is cross-border regulatory fragmentation. Differing standards raise production costs, limit economies of scale, and discourage companies from expanding their fortified product lines [9].

Proven Solutions

Some countries have started to address these barriers. Governments can ease cost burdens by removing import duties and VAT on premix and testing equipment [7]. Organisations like GAIN have further reduced premix costs through volume-based procurement. According to the Millers for Nutrition report, consolidated bulk orders can reduce premix prices by 20–50%, depending on scale [12].

Better enforcement can also be achieved through strategic restructuring. Ethiopia, for instance, has consolidated salt processors into centralized hubs, allowing more efficient and consistent quality checks [11]. In Kenya, the Strengthening African Processors of Fortified Foods (SAPFF) initiative helped raise compliance among food processors from 28% in 2018 to over 50% by 2023 by combining technical assistance with updated national standards [12].

The private sector itself is also stepping up. In some markets, industry-led co-financing of oversight activities is creating fairer competition

while building a shared commitment to fortification goals [12].

On the demand side, awareness campaigns and clear front-of-pack labeling, such as India’s “F+” symbol, help build consumer trust [5].

Education plays a pivotal role in increasing acceptance, especially where fortified foods may be the only reliable source of key nutrients.

Policy harmonization is another enabler. Aligning national regulations with Codex standards can cut down on duplication and allow companies to expand fortified offerings more efficiently across borders [9].

Financial and market-based incentives also make a difference. When food processors gain access to institutional buyers, export markets, or preferential financing, fortification becomes not only viable but also attractive as a business strategy [12].

BioAnalyt’s Role in the Fortification Ecosystem

Food fortification works, but only when implemented effectively. That requires reducing cost barriers, strengthening accountability systems, and fostering collaboration between public authorities and private sector players.

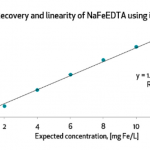

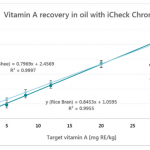

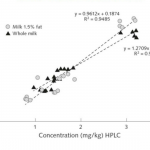

This is where organizations like BioAnalyt play a pivotal role. With its portable iCheck devices, BioAnalyt enables on-site, real-time measurement of key micronutrients in fortified foods. In regions with limited regulatory capacity, this tool ensures that producers, inspectors, and development partners can verify nutrient content and maintain quality standards safely and reliably.

Bridging the Implementation Gap in Food Fortification

Food fortification is a proven solution to a global health problem, but its success hinges on more than just regulation. As we’ve explored in this article, challenges like cost, compliance, consumer awareness, and fragmented regulations often limit impact. However, targeted support, smarter incentives, and stronger collaboration, especially between public institutions and private industry, can turn fortification from a mandate into a movement.

To truly deliver on the promise of fortification, stakeholders must commit to shared responsibility, invest in quality-assurance tools like BioAnalyt’s iCheck, and scale technical services such as those provided by QuImpact. Only then can we close the implementation gap and ensure that fortified foods fulfill their potential, from policy to plate.

References

- The Lancet Global Health (2022).

- World Bank, Investment Framework for Nutrition (2024).

- Global Fortification Data Exchange, Technical Brief: Global Status (2021).

- World Bank & WBCSD, Food Fortification Playbook (2024).

- Hystra, Large-Scale Food Fortification: Building the Business Case (2025).

- TechnoServe, Micronutrient Fortification Index in Nigeria (2023).

- Ayako et al., Case Study on Edible Oil Fortification in Bangladesh (2021).

- FNS Playbook, Consumer Awareness and Behavior (2024).

- FNS Playbook, Policy Harmonization and Regulatory Barriers (2024).

- GAIN Premix Facility, Fortification Supply Chain Insights (2023).

- Yusufali et al., Salt Iodization in Ethiopia: Centralized Facilities (2022).

- M4N Report – Large-Scale Food Fortification: Building the Business Case for the Private Sector (2025).